“Prices for a lot of popular watches and big-name luxury brands are going up,” ABlogtoWatch founder Ariel Adams predicts “The bad is news that the watch industry will probably raise watch prices on a lot of popular timepieces, and entire brands might up their average price points anywhere from 20% to 80%.” The good news is that Mr. Adams is wrong . . .

What this doesn’t mean is that all watches prices are going up, but rather prices from many popular brands. Naturally, smaller or second-tier brands will enter now abandoned price categories left by primary brands.

So, there will always be wristwatches at all price categories, but the entry point for serious luxury timepieces is probably going to be raised.

That almost makes sense. But not quite. Mr. Adams’ astrology-level-vague prediction — that watch prices are going to soar on “a lot of popular timepieces” and “entire brands” — ignores the immutable law of supply and demand.

Watch prices will only rise if demand is strong – both in terms of the overall market and an individual watchmaker’s products. According to Mr. Adams, the market for luxury watches is weak and getting weaker. And that means . . .

The response to fewer overall global sales for luxury wristwatches is to increase the price of each timepiece in order to make up for the lower overall production.

Demand is falling! Raise watch prices! Said no watchmaker ever. In fact, there’s evidence that demand for watch is actually increasing. And evidence that Mr. Adams has lost touch with reality.

Another challenge the watch industry struggles to overcome is the stagnation in the economy. People aren’t making as much money as they used to, and not enough new people are becoming rich.

Existing rich people are mostly well-insulated from the recession, but they are a finite buying pool. The watch industry of today must face the reality that its most likely customers in the coming years are existing customers, not the new customers it keeps scouring the planet for.

Well that’s just plain wrong. Reliable statistics tell us the rich are getting richer. They’re a percentage of the population, and the population continues to increase. Do the math. Then add sales from the ridiculously robust Chinese market.

The watch industry is, unfortunately, not earning enough money right now to just decrease production volumes without lowering prices.

Sure, some brands could do that, but as a whole, the cost of producing watches, including the number of suppliers involved, means that a lot of people need to eat each time a Swiss-made watch is produced. That means consumers of most big-name watches will have to accept higher costs in order to enjoy similar watches because fewer of them are actually being produced.

I’m so confused! Why would decreasing production force a watchmaker to lower prices? Was that a typo? Decreasing production helps maintain price. At least in theory.

. . . the market for wristwatches is established and stagnant, which means brands will need to routinely sell to the same group of consumers — a group that happens to be mostly wealthy and able to absorb even appreciable price increases. Regular watch collectors might want to start planning and spending accordingly.

I guess Mr. Adams is talking about “serious” quartz and mechanical watches. ‘Cause the market for smartwatches/wearables is going mental, expanding at more than 20 percent per year, innovating by the hour.

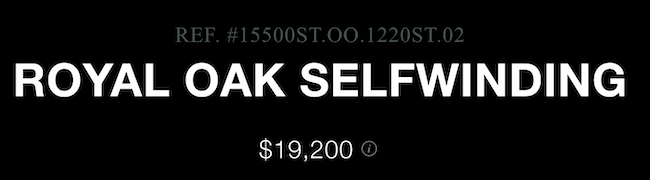

As for luxury watch prices rising by 20 to 80 percent, nope. Not happening. Not even for Holy Grail pieces.

There’s a reason Rolex hasn’t hiked-up the price of a stainless steel, panda-faced Daytona to reflect used market values. The same reason Audemars Piguet and Patek Philippe hold the line on the prices of their most desireable watches: the higher they price their Grail watches, the less desirable the non-Grail variants seem. And they want to sell a lot of non-Grail watches.

Not to mention the fact that competition is fierce at all levels of the watch industry. Getting the balance between supply and demand is a never-ending battle against both consumer tastes and the competition. Price is where the rubber meets the road.

But all marketing starts with the product. Mr. Adams should continue to focus his talents on reviewing those products, and leave the business of the watch business to the business people whose business it is to make the watches he reviews.

Thanks for adding to the discussion. Oh, and you did find a typo that was confusing, and corrected.

I’m pretty solidly convinced that prices are going to go up as production volumes go down in the watch industry. I’m happy when people disagree – as frankly I don’t want prices to go up any more than you do.

So let’s just wait a few years and see what happens. Then we can see how these events around us unfold themselves.

Why would volumes go down? What’s the rationale there, or evidence that any of the currently successful watchmakers are trimming production?

If demand remains strong — and the stats say it IS remaining strong — prices stay high. Reducing volume would be crazy. You know, make hay while the sun shines.

[…] Big watch retailers get more in-demand watches to sell than small retailers. This is simple common sense. Watchmakers distribute highly desirable models to retailers as a percentage of a store’s total…. […]