As the watch world continues to grind through Coronageddon, we are starting to see the outline of what the post-pandemic new normal might be. More online sales, but not nearly enough to save everybody’s bacon; an even greater reliance on China, which is not the savior everyone is waiting for; and far fewer players as we head towards watch industry consolidation . . .

As we watch LVMH walk away from Tiffany, blaming Tiffany’s performance over the last several months, this last point may seem counterintuitive.

However, no less than Georges Kern, the CEO of Breitling, is expecting to see consolidation throughout the watch industry. He’s right, you know. In fact, the industry has been ripe for such a consolidation for years now. It just took the pandemic to get things moving.

M&A in the retail world depends on a few necessary conditions . . .

Manufacturing alignment

Mergers of companies with similar supply chains (in terms of materials, cost structure, and suppliers) are easier to execute. Most middle-tier watch brands differentiate themselves with design and marketing rather than exotic materials and don’t manufacture on a scale that requires specialized investment. So integrating two companies is relatively straightforward.

Sympathetic channel strategies

Two companies with dissimilar channel schemes – for example, completely online vs owned stores vs authorized dealers – will have trouble merging their operations and customer base (not to mention inventory strategy, margins and revenue models).

Prior to Coronageddon, the watch industry was fragmented in this regard, making acquisitions more difficult. However, the pandemic has forced everyone to go to a more direct online model (which isn’t going away).

As larger manufacturers build out their own online capabilities, integrating new brands into a wholly-owned direct-to-consumer online channel is easier. In fact, it’s a good way for a larger company to experiment with online without alienating its dealer base.

Lower valuations for targets

Retail, even at the luxury level, isn’t an easy business. Tiffany’s TTM EBITDA margin is 17%; compare that with Apple (30%), Google (29%), and Facebook (45%). With higher fixed and marketing costs than in many sectors, company valuations are dependent on growth. Not a lot of that is happening right now.

We already know manufacturers will have trouble staying afloat but at the same time valuations have fallen as growth disappears. The larger players like the LVMHs of the world are going bargain hunting right now, looking for a few acquisitions of companies that have a strong brand recognition but lacking the market clout to ride out the pandemic.

Uncertainty makes stronger brands more acquisitive

As the cliche goes, diversity is strength. The typical growth strategies aren’t working, and as we have said, China ain’t all that.

Brands with cash are going to want to ensure that they’re well positioned to survive and thrive in whatever the world looks like in 2022. Placing different bets on different markets and different demos is a good way of doing this: you may become less profitable in a short run but you smooth out the bumps.

You also get the economies of scale in manufacturing and more sway with your channels, both of which will boost profitability. It’s a profoundly conservative way of looking at corporate growth but these are profoundly conservative times the manufacturers are living through right now.

The Big Fish Get Bigger

I’m on record saying that Coronageddon is going to be worst for the middle class of watch manufacturers, being caught between smartwatches below and lots and lots of larger brands with much deeper pockets above.

This leads to a brutal bottom line calculation: larger conglomerates continue to get larger. Buy the brand; fire the overhead (i.e., everyone) replace the movements with your own or use your economies of scale to get the cost down; then flog these across your channels as much as possible while you can. At some point you’ve wrung all you can out of your acquisition and you continue on your merry way.

Who’s ready to go shopping?

-40-

Click here for the Coronavirus Watch archives

“As the cliche goes, diversity is strength.” The reality on the ground is that focus is winning. Look at Apple, Rolex, Patek Philippe, and Audemars Piguet.

These are the watch brands that do over $1 billion in sales, in order of revenue size: Apple, Rolex (as a brand, excluding Tudor), Omega, Cartier, Longines, Patek Philippe, Audemars Piguet, and Tissot.

Next up, at just under $1 billion, is Richard Mille.

Swatch Group is a manufacturing powerhouse that delivers unparalleled value in its lineup, and Cartier has a brilliant legacy that not even Richemont has managed to ruin. But the rest of the story is focus, focus, focus.

I don’t know that anyone is going to be jumping to buy dying brands instead of focusing on their own existing portfolios. And with ETA backing off outside supply the big players have already built up their in-house manufacturing capability. If any M&A activity was to happen it would be something like LVMH buying Sellita, if the Swiss would even allow that.

Ah, but of those top brands, only three – Rolex, PP, and AP are actually independent. Every other one is part of much larger conglomerate. Having that backing is exactly what allows them to focus, since they themselves are part of a larger diversified strategy. Not to mention the incredible economies of scale and distribution that that allows them – higher profit margins absolutely help smooth out the mistakes (cough – 11.59 – cough).

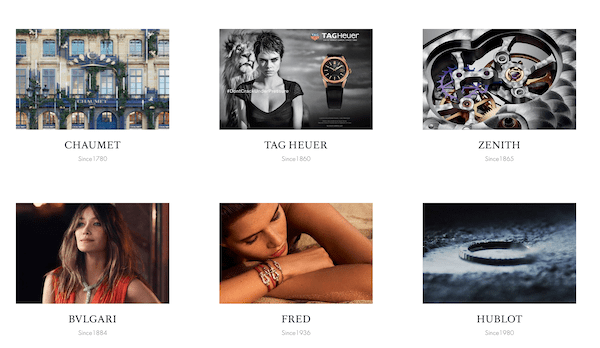

And picking up fallen brands and utilizing your manufacturing and marketing capability to revitalize them has its precedent: look at the Swatch Group and LVMH in the 80s and 90s.

(Richard Mille seems to only do 5k watches a year, so they’re not even close to a volume manufacturer)

[…] https://thetruthaboutwatches.com/2020/09/watch-industry-consolidation-coronavirus-watch-37/ […]