Pre-Coronageddon, Rolex made some one million timepieces a year. Despite those vast production numbers, Rolex prices have been steadily climbing. Buyers were willing to stretch their budget -Rolex was the “safe choice.” Come hard times, they could convert their pricey watch into cash. Maybe not as much as they paid, but some. Well hard times are here . . .

“Unemployment in the U.S. this year might not match the 25% peak during the Great Depression of the 1930s, but it could come pretty close,” marketwatch.com reports. Meanwhile, the U.S. economy contracted by five percent in Q1. Gross domestic product is down nine percent for Q2. ‘Nuff said?

It was more than enough for a lot of Rolex owners, who know a fan – excrement collision when they see one. They’ve sold their Rolex watch or watches. Enough of them have done so that the supply of pre-owned Rolex now exceeds demand, torpedoing pre-owned prices.

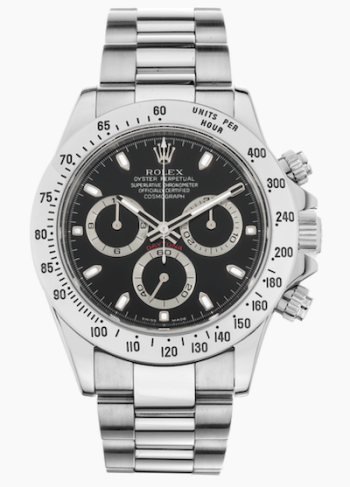

Two weeks ago, you couldn’t buy a pre-owned Oystersteel panda-faced Rolex Daytona for under $23k. The one at the top of this post is selling for $19k. The depreciation curve is so striking – Rolex losing value! – even watchpro.com’s cheerleaders felt obliged to mention it.

[Chrono24] gives examples of Rolex’s GMT Master II with a Pepsi bezel, which has seen prices fall by 7% over the past month to an average of $16,743. That is still almost double the recommended retail price of $9,295.

Um, how about $12k? Watchpro doesn’t want you to feel bad for people who flipped their GMT, or think for a minute that the Rolex brand isn’t the sine qua non of luxury watches.

Fair enough. Rolex makes a nice watch. Given Crown & Caliber’s markup, the Pepsi owner probably got their original money back. But that’s not going to hold true for tens of thousands of cash-strapped Rolex owners. The market is flooded.

Like other online watch dealers, watchbox.com has stopped buying pre-owned Rolex. Like other online watch dealers – and all real-world Rolex watch dealers – they’re sitting on a significant stockpile of pre-owned pieces. As we reported in Coronavirus Watch 12, Bob’s Watches has over 500 Rolex to flog – that they want to talk about.

Rolex is starting up production again – a decision that adds to the supply and pressures their authorized dealers (ADs) to move the metal. There are two ways for an AD to make room for new inventory (or risk losing their franchise): sell watches to customers or quietly offload them to gray market dealers like jomashop.com.

See that $2k gray market premium on a new-in-box Rolex Submariner? That used to be $4k. It could well become no k if Jomashop can’t sell their Subs for more and they can still make a profit. Could a gray market Sub sink lower than an AD Sub? Sure. At some point, a Rolex AD might even take a haircut to get the watch out of the door to make room for . . .

Grail watches. Our man Adams tackled this in a separate post. Suffice it to say, if Rolex needs cash, why not eliminate self-imposed restrictions on steel panda-faced Daytonas, Pepsis, Hulks, etc. to generate revenue for themselves and, crucially, their struggling authorized dealers?

Soaking up that demand would put more downward pressure on pre-owned Rolex prices. And here’s the real fun factor: we hear executive types are bailing out of their expensive Rolex purchase – of a suddenly available Sub and such – because they’ve had to fire people and showing up with a new Rolex isn’t a good look.

Supply up, demand down, prices down. How far and how long that vicious circle spins is anyone’s guess. At the moment, it shows no signs of slowing, and every sign of accelerating.

[…] late. As we’ve shown numerous times, the luxury watch market is already flooded. The grey market is chock-a-block with previously unobtainable pieces at reduced prices. Coronavirus […]