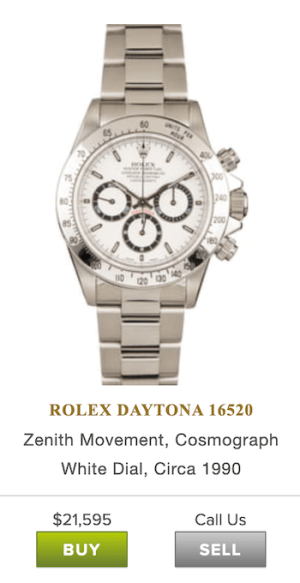

A piece of genuinely good economic news arrived on Friday: payrolls rose by 2.5m, and unemployment fell. The economic recovery may be beginning and it may be V-shaped. Maybe. Naturally, we asked ourselves “were we wrong to proclaim ‘Rolex prices drop'”? I mean, has the drop stopped? Bob’s Watches CEO Paul Altieri has some relevant intel . . .

“The crisis has cooled prices by 10-20% for the hottest Rolex watches,” Mr. Altieri told watchpro.com. Copy that. But not this: “Now is a great time to buy.”

Anyone waiting for the day when Mr. Altieri says “this is a bad time to buy” will wait ’til End of Days, and then some.

Even as Rolex prices drop, this is not a great time to buy a Rolex or similar if you’re one of the 20m+ unemployed Americans. Or someone employed but wary of your future prospects in the middle of a global recession.

Just so we’re clear, cnbc.com reminds us that “the current unemployment rate is at its highest level since the Great Depression.” And if you really need a buzzkill buzzfeed.com has you covered.

Never mind that. Mr. Altieri “expects [prices] to rebound to pre-pandemic levels because supply is just as tight today because of three months’ loss of production at Rolex.”

Our man Adams addressed this theory in Coronavirus Watch 23: Watchpro Hearts Slumping Demand. Short answer: Rolex’s reduced production is not as great as the reduced demand for Rolex.

The “tight supply will firm-up prices” prediction also assumes Rolex can’t ramp-up production to meet rising demand, should it rise. They can. This is a company that made 1m watches per year. The bigger question: can Rolex afford not to crank out watches? They’ve got a lot of mouths to feed. Unionized mouths.

Don’t worry about Rolex’s production schedule or profitability. Business 101: when your competitors are hurting, put your foot on the gas. Rolex, Patek, and the other big boys are doing just that.

Patek did a complete 180 and announced they’ll be rolling out new models. Rolex may well be pumping out grail watches. They’re sticking a thumb in the eye of the smaller players, who are currently playing a very high stakes game of Russian roulette.

Remember: big watch brands don’t sell to the public. They sell to dealers. Watches shipped are watches sold. Rolex doesn’t particularly care if dealers are carrying too much inventory. If dealers go belly-up, well, Rolex was trimming dealers before Coronageddon. What does that tell you?

Make no mistake: Coronageddon hit Rolex retail hard. Combine the lack of traffic over the last several months, the depressed economy, the looting, stir and you get misery.

The immediate problem of losing an entire quarter is nothing compared to what will happen if Corona 2: Electric Boogaloo hits during the Christmas shopping season.

Meanwhile, Rolex will most likely continue turning a blind eye to authorized dealers shoveling unsold inventory into gray market dealers. Which reduces prices.

Rolex dealers and their colleagues selling other luxury watch brands have hung the hat of its hopes on post-Coronageddon “revenge shopping.” There was an uptick when some markets re-opened – not that we can trust reporting from China (where the government gave consumers vouchers) – but there’s a new kid in town: revenge saving.

The Wall Street Journal reports “As of April 22, the U.S. personal savings rate hit an all-time high of 33%, up from 12% in March, according to the U.S. Bureau of Economic Analysis.” One thing’s for sure: the money saved is not buying a new Rolex.

Here’s a report from China that highlights the general trend:

As the epidemic eases, the demand to sell is growing among consumers eager to make money and de-clutter. Like Ting, some shoppers are more eager to clean out their closet due to financial incentives.

Statistics show on the second-hand shop platform Idle Fish, in March, the daily average number of transactions and amount of has reached a record high, the number of new sellers increased by 38.8% year-on-year.

Are cash-strapped Americans selling their Rolex? They are. Mr. Bob reported that he has over 500 watches in inventory. Other re-sellers have stopped taking all but highly desirable Rolex. Makes sense, right?

Bottom line: if we’re talking about pre-owned Rolex wait. There’s no indication that demand is increasing and plenty of evidence that supply is.

If we’re talking about new Rolex, the company will NOT reduce its retail prices. Period. They’ll sit it out. BUT authorized Rolex dealers can deal, and there’s plenty of margin with which to deal: forty percent.

Even so, if it’s a new Rolex you want at a reduced price, wait. Dealers are not desperate enough yet. If Christmas season sucks, things will get pretty damn dire. You’ll watch Rolex prices drop across the board (although you’ll have to show up at a dealer and ask for a discount on a new Rolex).

Meanwhile, watch this space, safe in the knowledge that we’re keeping an eye on Rolex prices and availability. If we have to eat our words we will. You’ll be the first to know.

Click here for the Coronavirus Watch archives

[…] Click here for Coronavirus Watch 24: Rolex Prices Drop 20 – 30% dated June 10, […]

Excellent blog. I love the independent, critical analysis. My guess is that prices will go down for a different, but related, reason. Showing off expensive baubles will be uncool for a long time except in the most insulated of social circles. A Rolex on your wrist today is more likely to be met with “eeew” than “oooh.”

We have raised that subject several times. Most recently in the Coronavirus watch series, pointing out that several people cancelled their orders.